Der TCFD wurde offiziell aufgelöst und wird im Juli 2024 durch die Sustainability Disclosure Standards (SDS) ersetzt, mit einigen Änderungen in der Treibhausgasberichterstattung. Diese Standards werden den Richtlinien der International Financial Reporting Standards (IFRS) Foundation und dem International Sustainability Standards Board (ISSB) folgen.

Die SDS wird einen neuen, detaillierteren Rahmen für die internationale ESG-Berichterstattung, das Risikomanagement und klimabezogene finanzielle Offenlegungen bieten.

Der IFRS wird ab 2024 die Überwachung der klimabezogenen Offenlegungen von Unternehmen übernehmen. Die IFRS-Initiative wird den Empfehlungen und Standards der TCFD Taskforce weitgehend ähneln, mit einigen Änderungen und Einflüssen des ISSB, das nach mehr Detailreichtum und Transparenz bei der Offenlegung von Risiken für verschiedene klimabezogene Szenarien verlangt.

Die Task Force on Climate-Related Financial Disclosures (TCFD) wurde 2015 vom internationalen Financial Stability Board (FSB) gegründet, um einheitliche klimabezogene Risiken offenzulegen, die von Unternehmen, Banken und Investoren genutzt werden können. Ziel ist es, weltweit finanzielle Stabilität zu gewährleisten, da der Klimawandel unsere Wirtschaft negativ beeinflussen wird.

Das Hauptziel der Berichterstattung nach TCFD besteht darin, die klimabezogenen Risiken und Chancen eines Unternehmens sowie die finanziellen Auswirkungen offenzulegen, die diese auf die Geschäftstätigkeit und das Geschäftsmodell des Unternehmens haben könnten.

Die TCFD-Berichtsrahmen bieten konsistente und transparente Informationen für alle Finanzakteure und globalen Märkte. Durch diese Initiative werden klimabezogene Offenlegungen von Unternehmen konsistenter und vergleichbarer. Zudem ist die TCFD der Ansicht, dass bessere Informationen es Unternehmen ermöglichen, klimabezogene Risiken und Chancen in ihre Risikomanagement-, strategische Planungs- und Entscheidungsprozesse zu integrieren. Dies ermöglicht auch eine bessere ESG-Verwaltung und die daraus resultierende Leistung.

Der TCFD ist kein unternehmerischer Berichtsstandard, sondern eine Methode, um zu verstehen, wie Unternehmen die finanziellen Risiken und Chancen im Zusammenhang mit dem Klimawandel angehen.

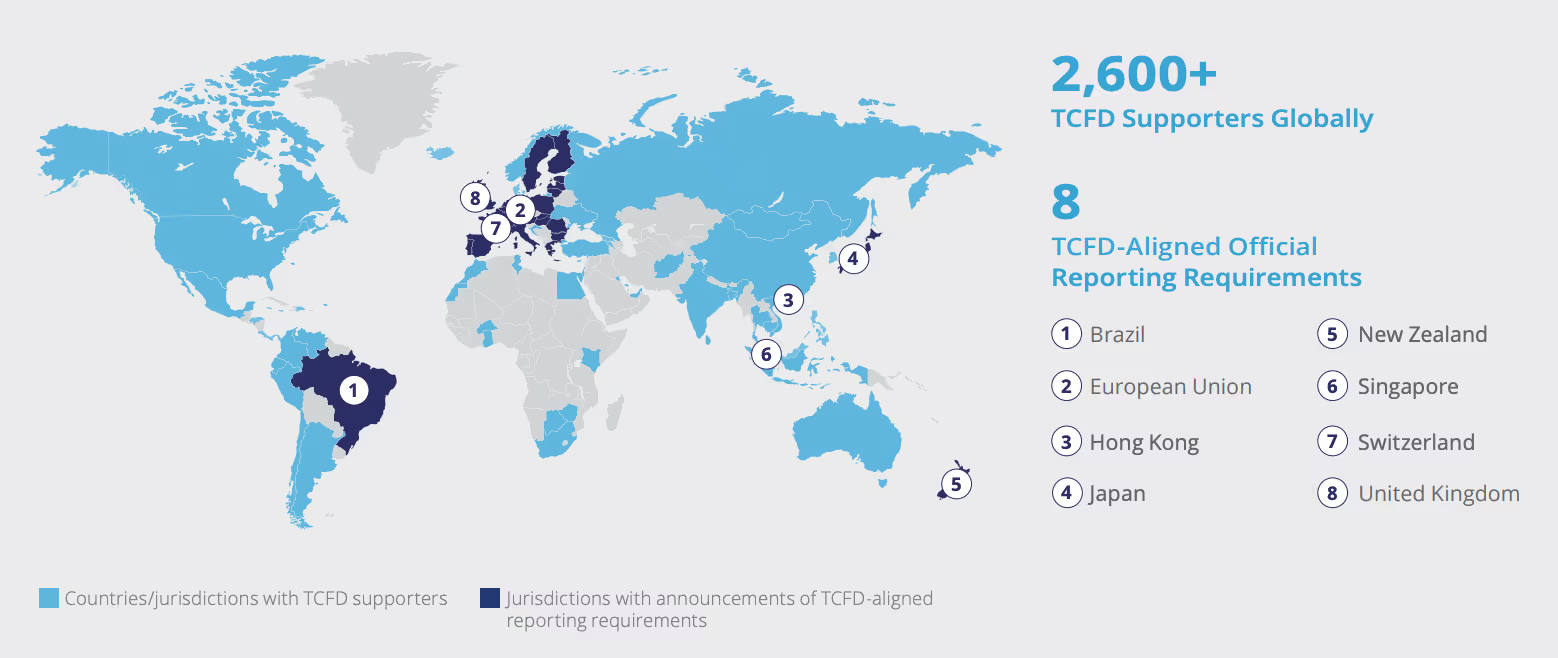

Die TCFD ist weiterhin hauptsächlich ein freiwilliger Rahmen für Unternehmen aller Größen, Branchen und Gerichtsbarkeiten. Allerdings erwägen immer mehr Länder, TCFD-konformes Berichtswesen über Klimarisiken verpflichtend zu machen. Unternehmen müssen beginnen, sich an die TCFD anzupassen, um der Konkurrenz voraus zu sein, eine zukunftssichere Roadmap für ihre Betriebsabläufe zu entwickeln, um aktuellen und zukünftigen Klimarichtlinien zu entsprechen, und Zugang zu fortschrittlichen finanziellen Ressourcen wie Unternehmensgrünanleihen zu erhalten.

Ab dem 6. April 2022 müssen über 1.300 der größten in Großbritannien registrierten Unternehmen und Finanzinstitute verpflichtend klimabezogene Finanzinformationen offenlegen.

Ab April 2022 sind britische Unternehmen mit den folgenden Kriterien verpflichtet, TCFD-konformes Reporting vorzunehmen:

1. Alle britischen Unternehmen, die derzeit verpflichtet sind, eine nichtfinanzielle Informationen Erklärung zu erstellen:

2. In Großbritannien registrierte Unternehmen mit an AIM zugelassenen Wertpapieren und mehr als 500 Mitarbeitern.

3. Die im Vereinigten Königreich registrierten Unternehmen, die nicht in die obigen Kategorien fallen, haben mehr als 500 Mitarbeiter und einen Umsatz von mehr als £500 Millionen.

4. LLPs, die mehr als 500 Mitarbeiter haben und einen Umsatz von mehr als £500 Millionen erzielen

.avif)

Ein TCFD-konformer Bericht sollte alle relevanten Informationen zu den klimabezogenen Risiken und Chancen eines Unternehmens sowie die daraus resultierenden finanziellen Auswirkungen enthalten.

Die TCFD verlangt von Unternehmen und LLPs, dass sie klimabezogene Finanzinformationen in Übereinstimmung mit den vier übergreifenden Säulen der Empfehlungen der Regelung verpflichtend offenlegen (Governance, Strategie, Risikomanagement, Kennzahlen & Zielsetzungen). Lassen Sie uns nun erläutern, wie diese Empfehlungen definiert sind:

Diese notwendigen Offenlegungen helfen Investoren und anderen zu verstehen, wie berichtende Organisationen klima- und umweltbezogene Risiken sowie Chancen und deren wirtschaftliche Auswirkungen berücksichtigen und bewerten.

Finden Sie weitere Informationen in der TCFD Guidance on Metrics, Targets and Transition Plans und den TCFD Recommendations of the Task Force on Climate-related Financial Disclosures.

Die TCFD hat sieben Prinzipien für angemessene Offenlegungen definiert:

Die Vorschriften sollen bis Ende 2021 fertiggestellt werden und treten am gemeinsamen Stichtag, dem 6. April 2022, in Kraft. Sie gelten für Abrechnungszeiträume, die an diesem Datum oder danach beginnen.

Daher müssen die meisten Unternehmen mit einem kalenderbasierten Geschäftsjahr die verpflichtenden klimabezogenen Finanzangaben zum ersten Mal in ihren Jahresbericht und die Jahresabrechnung für das Geschäftsjahr aufnehmen, das am 1. Januar beginnt und am 31. Dezember 2023 endet.

Bleiben Sie mit der Berichterstattung über klimabezogene Risiken im Einklang mit der TCFD. Für Ihre Compliance-Anforderungen hat Plan A die perfekte Lösung. Fordern Sie eine Demo an mit unseren Richtlinienexperten.