The carbon bubble might cause the next financial crisis. Over our lifetime, we have experienced many crises: the internet bubble, the global financial crisis of 2008, the US house market crash, and the recent crypto market dump. If all these bubbles had adverse effects on our economy, the carbon bubble burst might send shockwaves to our entire economy.

In this article, we explain what risks fossil fuels pose to the financial market and how we can protect our economic system from them.

What is the carbon bubble?

The “carbon bubble” stems from an overvaluation of fossil fuel companies’ oil, coal, and gas reserves. The notion of a carbon bubble is based on our knowledge that 2°C is the absolute maximum amount of temperature rise that humanity can cope with. Any more than that, and we will live on an inhabitable planet.

The “carbon bubble” started as a warning from a niche group of climate-minded financiers in the early 2010s but has since become accepted as orthodoxy by most major regulators and financial institutions.

Like the carbon bubble, financial bubbles occur when the price of an asset increases due to unrealistic projections of its value. Often, shareholders speculate that their investments will continue to be valuable, maintaining high stock prices and consumer confidence. Sometimes, however, demand and market conviction will be met with real-world situations that devalue the asset.

It is precisely the case for fossil fuel companies as the world tries to move away from these carbon-intensive energies to switch to renewables and low-carbon technologies. And, we are getting there. As evidence, two-thirds of solar and wind farms built in 2020 will provide cheaper electricity than even the most affordable coal plants – making renewables the cheapest power source today.

The carbon bubble and the overvaluation of fossil fuel companies

The carbon bubble problem arises when we consider that all fossil fuel reserves – every drop of oil and particle of atmospheric carbon – are currently included in the valuation of the companies that own them. These companies are massively overvalued unless we want to exceed our carbon budget. All companies on the stock market are evaluated on the basis that we will burn all of our reserves based on our current economic logic.

The overvaluation of fossil fuel companies is a real issue. Most Wall Street and valuation indexes analysts are doing their valuations based on misleading data. A recent RethinkX report points out that since 2010, $2 trillion has been invested in fossil fuels and nuclear power based on misleading assumptions about the value of these industries. The RethinkX report also found that Levelized cost of energy (LCOE) companies are overvalued by 400%, resulting in a potential market crash.

This carbon bubble situation is leading us to two potential outcomes. On the one hand, fossil fuel companies burn all of our reserves, clearly blowing our carbon budget and cooking up the planet beyond recognition. On the other hand, governments implement regulations to stop companies from extracting unburnable carbon, which would make these companies drastically overvalued overnight, causing the carbon bubble to burst.

The carbon budget

You might have noticed an increase in temperatures and natural disasters – and before we all become cooked beyond recognition, it is essential to limit the rise of temperatures to 2°C under the Paris Agreement.

To achieve the Paris Agreement goals, the world can release only a certain amount of greenhouse gas emissions into the atmosphere (caused by burning fossil fuels, oil and gas) – the so-called carbon budget. Any more than this, and we run over budget.

Carbon Tracker calculated the carbon budget for 2020, which was at 495GtCO2 – as of 2020, this equates to 11.5 years for a 50% probability of a 1.5°C warming outcome.

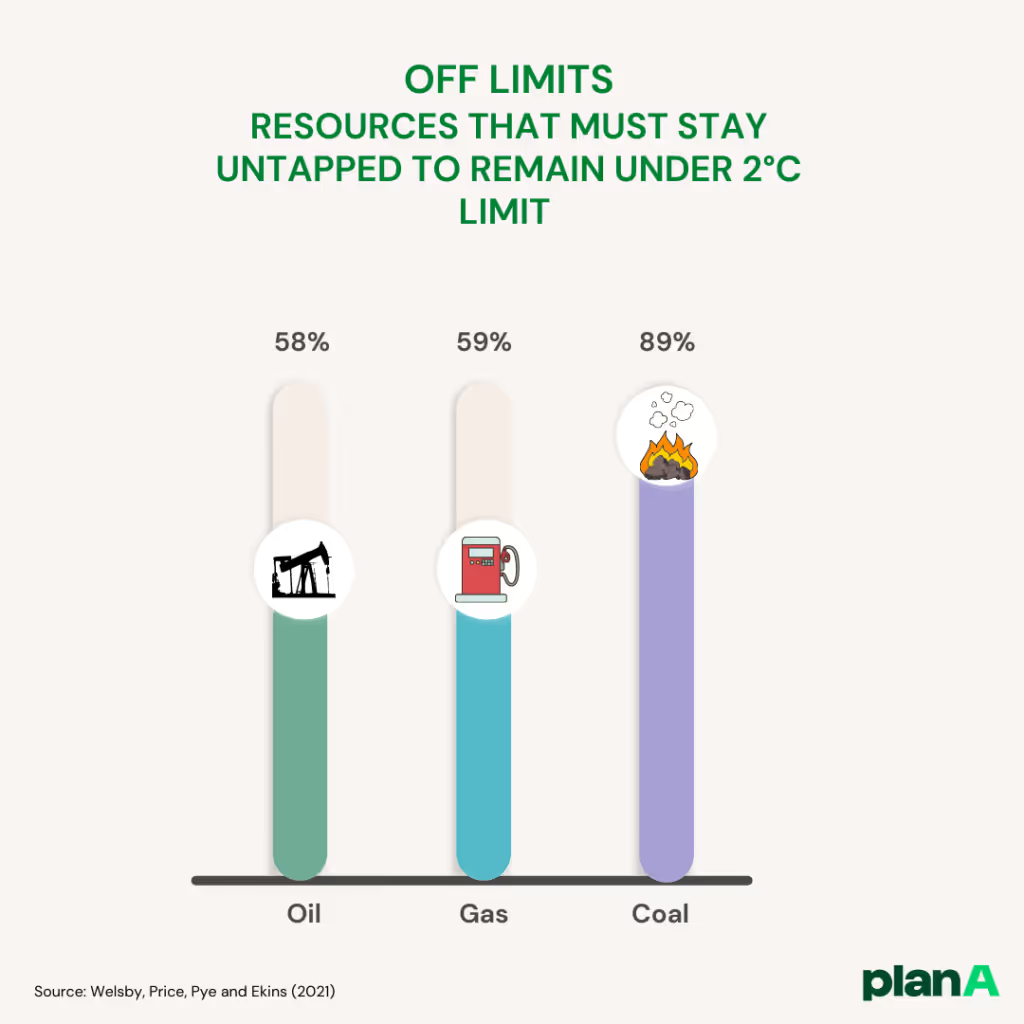

You get it: Our reserves must stay in the ground to keep the carbon budget. A 2021 study published in Nature proved that to have a 50% chance of staying within a 1.5°C temperature rise scenario, 60% of remaining oil and fossil methane gas reserves and 90% of coal reserves must remain unextracted by 2050. This so-called ‘unburnable carbon’ creates a fossil fuel overhang that we cannot use.

Why do carbon budgets matter to businesses?

A carbon budget follows similar lines to a business or country’s typical financial budget. They tell a business how much carbon dioxide they have left to emit to contribute to staying below a certain level of warming.

Carbon budgets are valuable for companies to develop a decarbonisation plan. A company can set a budget against its target in alignment with the 1.5 °C and, thanks to the budget, can create visibility around the “low hanging fruit” and leave the rest of the budget to the more complex decarbonisation challenges.

The carbon bubble effect: the financial risk of the century

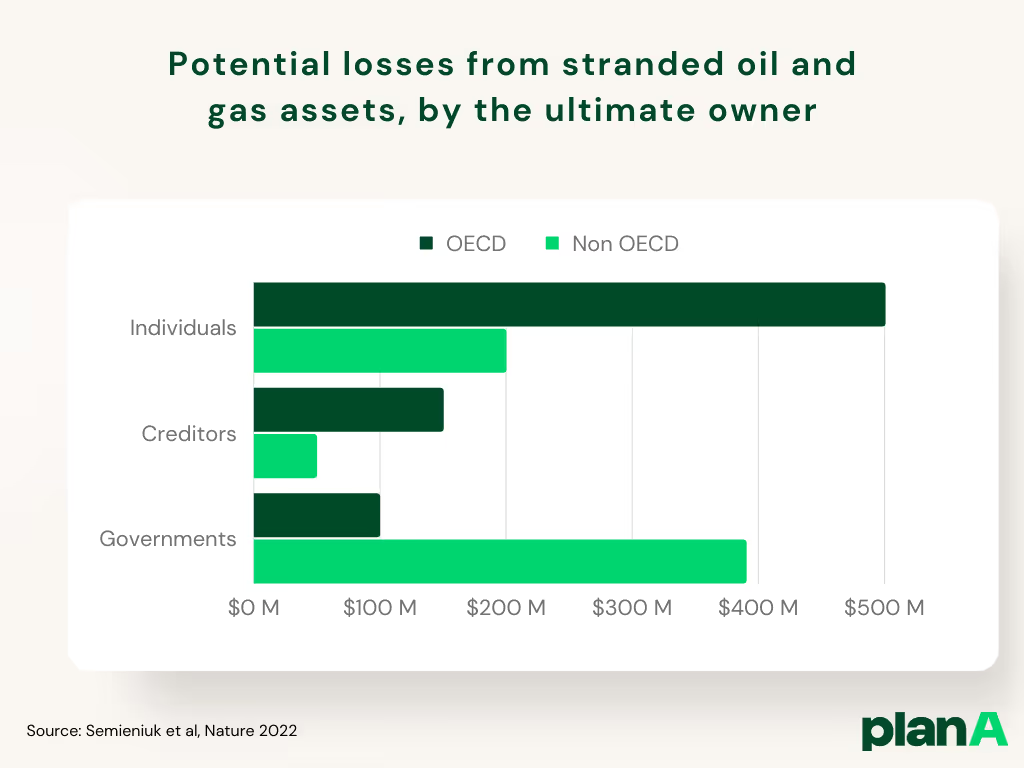

Similar to the butterfly effect, the carbon bubble effect has investors worried – and they should. Individual investors are projected to be sitting on a $763 million carbon bubble.

The value of stranded assets will be about $4 trillion, the latest Intergovernmental Panel on Climate Change report concluded. Another report stated more optimistically that stranded oil and gas production assets would total $1.4 trillion – if we meet the Paris targets to stay below 1.5 degrees. This figure is likely underestimated as it doesn’t include many ancillary assets and companies, like oil refineries and gas export terminals.

Credit: Nature (2022)

Not convinced yet? Take it from British investor Jeremy Grantham, who manages over $106 billion in assets, and divested all of his support from fossil fuels and coal in 2013.

He explains: “The probability of fossil fuel companies running into trouble is too high for me to take that risk as an investor. If we mean to burn all the coal and any appreciable percentage of the tar sands, or other unconventional oil and gas, then we’re cooked. There are terrible consequences that we will lay at the door of our grandchildren.”

I did not invest in fossil fuel companies, am I concerned by the carbon bubble?

We hope you did not, but your pension fund or asset manager certainly has. A 2020 study found that pension funds in OECD countries could collectively manage €238–828 billion in fossil fuel assets (up to $978 billion).

In 2021, half of the world’s 29 largest asset managers did not have the policy to exclude coal as an asset. And while many asset managers have pledged to be leaving coal behind, the world’s three largest asset management groups, BlackRock, Vanguard and State Street, still managed over $300 billion of fossil fuel investments as recently as 2019. On the bright side, Norway, the world’s largest sovereign wealth fund at $1.4 trillion, sold its stocks in fossil fuel companies in January 2021.

The carbon bubble all directly or indirectly impacts us. Divesting from fossil fuels is not only the right thing to do for our planet. It is the right thing to do for our economy. Start your net-zero emissions journey with Plan A.