To help improve the flow of money towards sustainable activities across the European Union, the European Commission adopted the ambitious and comprehensive Sustainable Finance Package. One of the proposed measures within the package is the Corporate Sustainability Reporting Directive (CSRD).

The CSRD has now officially been adopted by the European Union Council and amends the scope and the reporting requirements of the Non-Financial Reporting Directive (NFRD). While the NFRD only provided guidelines for ESG reporting, the CSRD introduces mandatory reporting standards for all large businesses.

What is the Corporate Sustainability Reporting Directive (CSRD)?

The CSRD aims to improve the transparency and consistency of sustainability reporting by companies operating in the EU. It is part of a broader trend towards increased disclosure and transparency around climate-related risks and opportunities, and can play an important role in promoting sustainable development and climate resilience. The regulatory framework mandates that public interest entities report on their sustainability performance since 2018, and must be reported on within the 2024 reporting year.

With its new requirements, the CSRD aims to ensure that businesses report reliable and comparable sustainability information so that investors can re-orient investments towards more sustainable technologies and industries. In addition to the NFRD disclosures, a company must disclose the following:

- Environmental protection

- Social responsibility and treatment of employees

- Respect for human rights

- Anti-corruption and bribery

- Diversity on company boards

Who needs to comply with the CSRD?

The CSRD will require more than 50,000 European companies to follow detailed sustainability reporting standards, this corresponds to 75% of all EU companies' turnover.

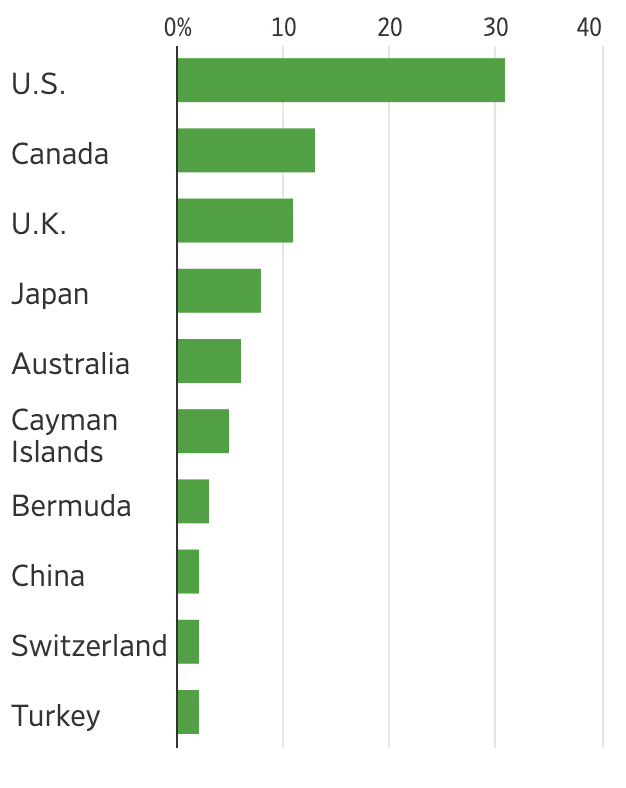

Such regulatory efforts, which aim to increase visibility on issues ranging from companies’ greenhouse-gas emissions to gender pay differences, will also require at least 10,000 companies outside the EU to disclose their sustainability performance. According to financial data firm Refinitiv, about a third of CSRD-affected firms outside of the EU are U.S based companies. Meanwhile, the analysis has identified that of the several thousand companies subject to the coming EU rules, 13% are Canadian and 11% are British.

Credit: Refinitiv

Which companies are actually required to comply with the CSRD?

While the NFRD only requires companies with more than 500 employees to report on their sustainability performance, the CSRD mandates that all large companies report on their sustainability.

Specifically, within the European Union:

- Companies with more than 250 employees and/or more than €40M turnover and/or more than €20 Million in total assets - and all listed companies (except micro-enterprises) will need to comply.

Meanwhile, the companies outside of the EU that the rules will apply to include:

- Non-European companies with branches or subsidiaries with a net turnover of € 150 million in the EU.

- Companies outside of the EU that have listed securities, such as stocks or bonds, on a regulated market in the European Union

- Companies outside of the EU that have annual EU revenue of more than €150 million, or about $163 million, and an EU branch with net revenue of more than €40 million

- Companies outside of the EU with an EU subsidiary that is a large company, defined as meeting at least two of these three criteria: more than 250 EU-based employees, a balance sheet above €20 million or local revenue of more than €40 million

When does the CSRD apply?

The following timeline provides an overview of when the CSRD will affect businesses::

- 2025: Businesses already subject to the NFRD will have to start reporting on the financial year 2024.

- 2026: Large undertakings not currently subject to the NFRD will have to start reporting on the financial year 2025.

- 2027: Small and medium enterprises and small and non-complex credit institutions and captive insurance undertakings will have to start reporting for the financial year 2026 - with a further possibility of voluntary opt-out until 2028.

- 2029: Non-European companies that have branches or subsidiaries will have to start reporting.

6 critical steps to prepare for the CSRD

Credit: Plan A

1. Set up and prepare a double materiality assessment

One of the key impacts of the CSRD which differs from current legislation is the requirement of a materiality analysis, via a double materiality approach. To carry out the double materiality assessment, all stakeholders and levels of the value chain must be evaluated, and the assessment should consider the short, medium, and long-term impacts of the business’ operations.

Businesses who wish to not only avoid risk, but develop an effective and impactful sustainability strategy, must ensure they perform a thorough materiality assessment. Yet, given the administratively challenging and time-consuming nature of materiality assessments, businesses impacted by the CSRD must not only take action immediately, but also utilise expert technology - such as Plan A’s comprehensive sustainability software - to ensure they are ready for 2024.

2. Develop a comprehensive understanding of the European Sustainability Reporting Standards (ESRSs)

CSRD-impacted businesses must start familiarising themselves with the exposure drafts of the mandatory reporting standards of the CSRD, the European Sustainability Reporting Standards. Businesses will be required to meet these standards, therefore it is crucial that a comprehensive understanding of the requirements is ascertained.

3. Collect and monitor data

Businesses must collect data from their own operations, suppliers, and business partners to be included in their sustainability reports. For the first time, the CSRD will adopt an EU-wide audit (assurance) requirement pertaining to ESG information. As such, CSRD-impacted businesses will be required to carry out due diligence practices and audits on their operations, such as reporting on scopes 1,2 and 3 of their carbon emissions.

However, such qualified data on its own is likely to not be enough to successfully comply with the CSRD. The data collection process utilised by businesses must be extremely reliable in order to ensure the sustainability claims relating to various suppliers, operators, and business partners is supported with reliable data and clear documentation. The most efficient way to streamline the data collection and analysis process is to utilise a CSRD reporting software and benefit from related support service allow businesses to save valuable time and resources.

Explore Plan A's CSRD Manager via the interactive demo below:

4. Align risk management with the business’ sustainability strategy

Businesses who comprehensively engage with the risk factors relating to sustainability from an early stage will be able to better align efforts with sustainability, their business value, and risk mitigation interventions. Research by Sustainalytics found that high to severe ESG incidents lead to 6% loss of market capitalisation on average; further emphasising the importance of aligning risk analysis with sustainability strategy. Meanwhile, the double materiality concept also considers the business impact that sustainability topics could have on the company's reputation and eventually their licence to operate, thus making this assessment a vital component to developing an impactful sustainability strategy.

5. Integrate reporting

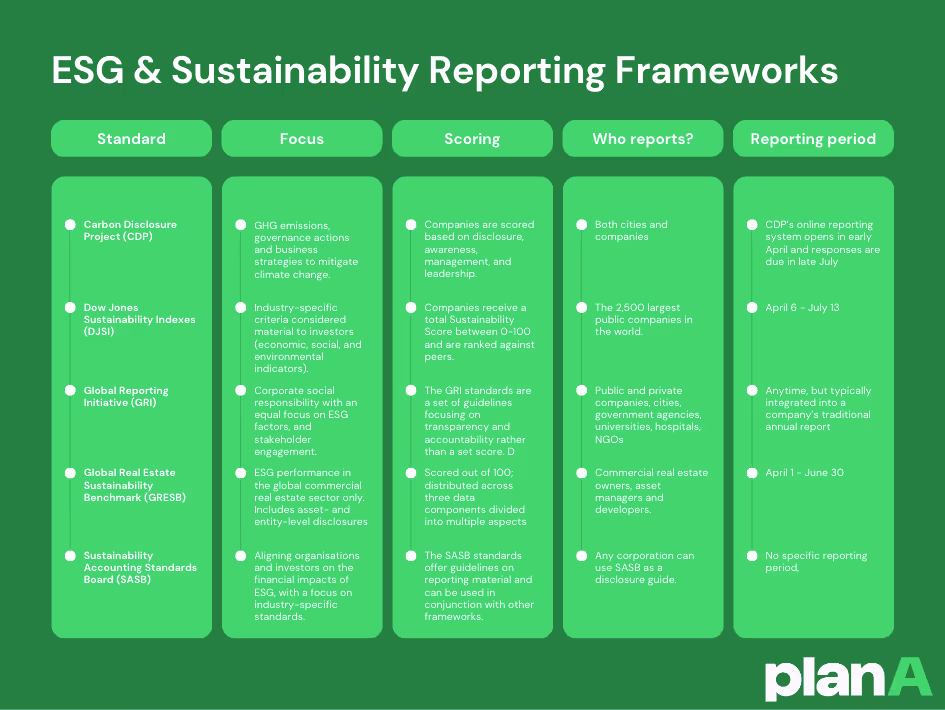

To ensure that the overall management report that CSRD-affected businesses are required to publish is transparent and effective, It is highly encouraged that the guidelines of a reporting framework are closely followed. Utilising a reporting framework as a guide will ensure businesses can go beyond the minimum requirements in communicating their sustainability performance, thus meeting the growing demands of stakeholders. Meanwhile, CSRD-affected companies must also ensure that their reports are able to be accessed digitally and that they are verified via an independent audit.

Read more about ESG reporting here.

6. Voluntarily comply as soon as possible

A fundamental step to not only preparing for the CSRD, but also effectively integrating sustainability into overall business processes, is abiding by such requirements on a voluntary basis. Regardless of whether businesses are currently under the scope of the CSRD, these requirements should be used as a rule-of-thumb to ensure sustainability becomes a pillar of the business’ operations as early as possible. This will not only be key to ensuring affected businesses are prepared for 2024, but also ensuring that non-affected businesses transition sustainably to ensure they are prepared for future compliance.

The vast requirements of the CSRD ultimately aim to ensure that businesses integrate reliable and comparable sustainability information into a verified reporting format. In doing so, investors will be able to re-orient resources towards more sustainable technologies and industries; accelerating the global journey towards net-zero. The risk of financial penalties, administrative sanctions and legal proceedings for companies who do not comply with the CSRD ultimately means businesses must take action immediately. Meanwhile, financial and non-financial benefits of sustainable transition makes decarbonisation a ‘no-brainer’ for businesses of all sizes around the globe.

To be fully prepared, businesses should start collecting data now. Plan A provides a comprehensive carbon accounting and decarbonisation platform that allows businesses to easily collect and streamline their emissions data, measure and analyse their carbon emissions, and report on their sustainability and ESG performance.

.avif)