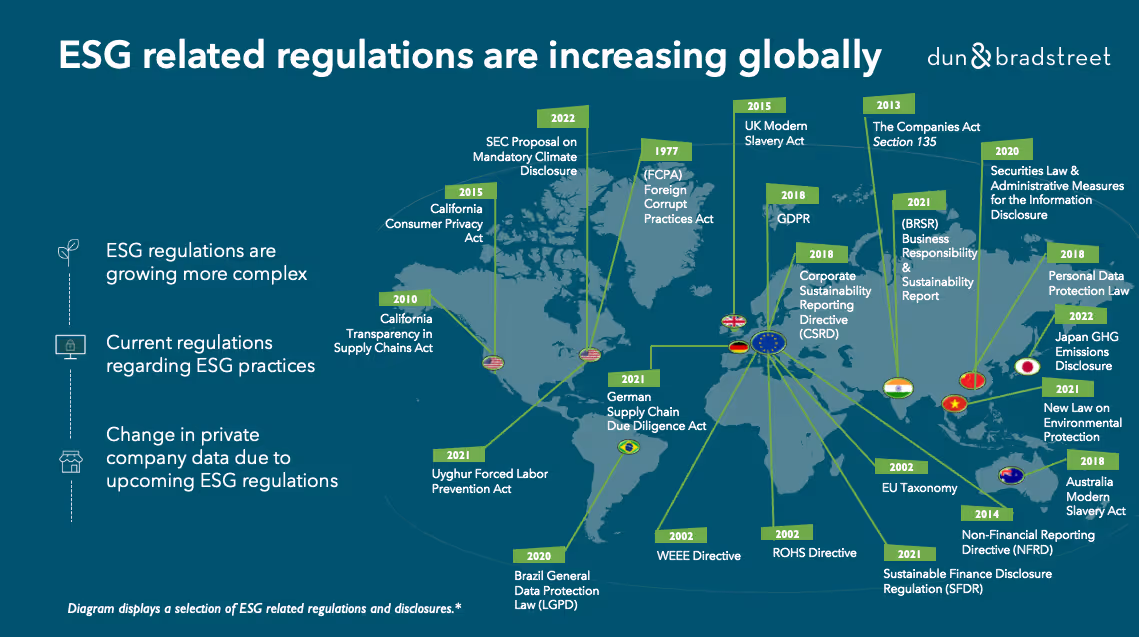

Environmental, social and governance factors (ESG) and its exponential influence upon businesses taking climate action, whereby businesses are increasingly placing ‘sustainability’ at the forefront of corporate strategy, has ultimately resulted in many businesses being uncertain of how to best allocate their resources in order to sustainably transition.

Sustainability can be an overwhelming issue and there are endless approaches to taking business climate action; thus, if a business attempts to develop a comprehensive strategy without any guidance, they risk facing a significant waste of resources. Whilst it may seem paradoxical, businesses are increasingly favouring the influence of regulations as they act as guidelines for best practice - particularly in relation to climate.

In light of the upcoming reporting cycle and growing awareness surrounding the long-term value potential of embedding sustainability as a key component of corporate strategy; it is ever so important that businesses understand and account for the influence of various regulatory bodies and frameworks.

Accordingly, this article will outline several key ESG regulatory bodies, regulations & frameworks which affect businesses of all shapes and sizes. Furthermore, this article will detail the influence of regulatory bodies upon sustainable business practice; and finally, how businesses can utilise ESG regulations & frameworks to their advantage.

The current landscape of ESG regulations & frameworks

Some of the key regulations and frameworks which are of vital importance to organisations include:

Task Force on Climate-Related Financial Disclosures (TCFD).

The Task Force on Climate-Related Financial Disclosures (TCFD) was created in 2015 by the international Financial Stability Board (FSB) to develop consistent climate-related financial risk disclosures for use by companies, banks, and investors. The aim is to provide financial stability globally, as climate change will negatively impact our economy. The main objective of TCFD reporting is to disclose the climate-related risks and opportunities of a company as well as the financial impact those might have on the company's operations and business model.

Corporate Sustainability Reporting Directive (CSRD)

The Corporate Sustainability Reporting Directive (CSRD) is the new EU legislation requiring all large companies to publish regular reports on their environmental and social impact activities. It helps investors, consumers, policymakers, and other stakeholders evaluate large companies' non-financial performance. Thus, it encourages these companies to develop more responsible approaches to business. For instance, it radically changes companies' scope and type of sustainability reporting. With the CSRD, the European Commission defines a common reporting framework for non-financial data for the first time.

Non-Financial Reporting Directive (NFRD)

The Non-Financial Reporting Directive (NFRD) requires companies in scope to publish a non-financial report on their ESG performance together with their annual management report. The NFRD aims to help investors, civil society organisations, consumers, policy makers and other stakeholders to evaluate the non-financial performance of large companies and encourages these companies to develop a responsible approach to business.

UK Disclosure Framework for Net Zero Transition Plans

The UK Disclosure Framework for Net Zero Transition Plans is a set of guidelines that companies can use to report on their efforts to transition to net zero emissions and support the transition to a low-carbon economy. The framework was developed by the Taskforce on Climate-related Financial Disclosures (TCFD), an organisation established by the Financial Stability Board (FSB) to promote consistent and transparent reporting of climate-related risks and opportunities, as companies increasingly announce net zero commitments, without publishing plans to support their targets. It is part of the UK government’s commitment to become the “world’s first net zero-aligned financial centre”.

On 8th November 2022 the UK’s Transition Plan Taskforce (TPT) published their Disclosure Framework and Implementation Guidance. It draws on existing and emerging standards and recommendations, including the TCFD, the Glasgow Financial Alliance for Net Zero (GFANZ) and the International Sustainability Standards Board (ISSB).

CDP - A climate disclosure framework for SME

CDP is a popular voluntary reporting framework that companies use to disclose environmental information to their stakeholders (investors, employees, and customers). The online response system is now open, and Wednesday the 26th of July 2023 is the deadline for businesses who wish to receive a CDP score.

EU’s Sustainable Finance Plans

In the EU's policy context, sustainable finance is understood as finance to support economic growth while reducing pressures on the environment and taking into account social and governance aspects.

EU’s “Fit for 55”

The European Union's Fit for 55 package aims to reduce greenhouse gas emissions by 55% by 2030. The European Commission proposed the package in July 2021; and in April 2023, the EU parliament confirmed the revolutionary climate targets. The legislation comprises; an overhaul of the Emissions Trading System (ETS), the establishment of a parallel carbon market, and an €86.7 billion social climate fund. This groundbreaking legislation signals a global shift towards greener policies and ensures a more sustainable future for the EU and the world.

The influence of ESG regulations upon the sustainability of business practices

Climate risk is financial risk.

The continued growth of reporting standards on a global scale further emphasises such a statement, and is no surprise; such standards are critical to ensuring that there is an aligned assessment of the cost of climate change to both businesses and governments.

- Businesses who do not continually analyse the regulatory landscape thus risk engaging in business actions and reporting practices which do not comply with relevant policies.

- As such, it is vital that businesses understand the relevant regulations which apply to them, the actions they must take to abide by such regulations, and which future regulations may influence them.

- Businesses should seek voluntary frameworks to ensure they are creating impactful and effective reports, thus mitigating financial risk and increasing transparency amongst stakeholders.

- Businesses who are proactive will hold the opportunity to become pioneers within the transition to a sustainable economy

How can businesses utilise ESG regulations and frameworks to strategically implement climate action?

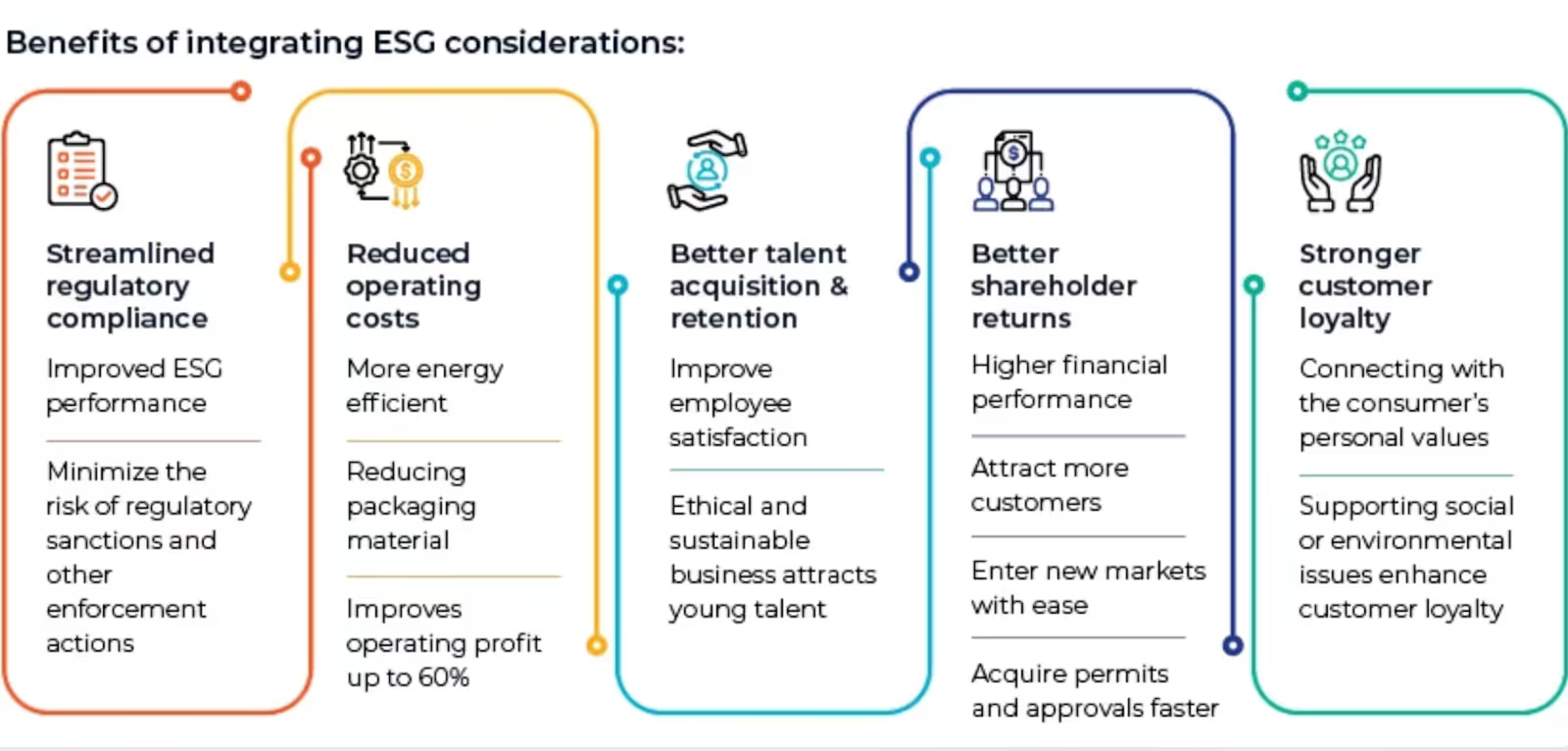

The implementation of regulatory standards acts as a guide for business practice, influencing corporate climate action and guiding sustainable practice. Simultaneously, the provision of voluntary frameworks which companies may utilise as a guide within key areas - such as reporting - is no less important within the transition towards a more sustainable economy.

The implementation of such net-zero targets and frameworks have been found to be highly effective. Through further unifying the way companies and countries understand concepts around climate change, sustainability and decarbonisation, such frameworks facilitate the alignment of language and action. However, it must be noted that the majority of such frameworks focus on historical assessment, and with a further heating planet, reporting on the past won't help us prepare for the future.

Businesses can leverage the aforementioned regulations and frameworks to their advantage in various ways, such as:

- Proactively ensuring compliance with the Corporate Sustainability Reporting Directive (CSRD) through active monitoring and reporting measures, (e.g. data collection) to avoid significant sanctions.

- For organisations reporting on the NFRD; understanding that the first CSRD report of companies in scope of NFRD is due in 2025 for the financial year of 2024. Given it is just a matter of time before the NFRD is replaced by the CSRD, businesses must seek information about the CSRD and how it impacts their company.

- For businesses affected by the TCFD, understanding that companies with a calendar financial year will need to include the mandatory climate-related financial disclosures for the first time in their annual report and account for the financial year commencing on 1 January and ending on 31 December 2023 is of fundamental importance to ensuring sustainability is a strategic priority, whilst mitigating further financial risk.

- Organisations should voluntarily utilise the UK Disclosure Framework for Net Zero Transition to take advantage of a consistent and transparent way to report on climate efforts, whilst actively accelerating the transition to net zero and supporting the transition to a low-carbon economy. The framework further provides investors, customers, and other stakeholders with the information they need to understand a company's efforts to address climate-related risks and opportunities. As such, the Uk disclosure framework provides immense value to those seeking to strategically leverage sustainability whilst actively contributing to the overall decarbonisation journey.

- Companies can utilise the CDP framework to further understand and report on the critical climate-related indicators SMEs should report on and use to inform their disclosures. Including this information in their mainstream reports or when using other data collection or reporting platforms will enable such companies to fulfil stakeholders’ demands for transparency; map and understand risks within their supply chain; and to benchmark their performance within the ent-zero transition, thus enabling a competitive advantage.

- Finally, reporting on climate risk and sustainability by understanding and ensuring compliance with various laws, such as the EU Climate Law, the EU Fit for 55, the EU Sustainable Finance Plan and Germany’s Climate Protection Act.

Ultimately, sustainability needs to become the global standard across the supply chains of globalised businesses in order to reach vital long-term climate goals, such as the UN’s Sustainable Development Goals. As such, regulatory bodies and frameworks are absolutely crucial in minimising financial and environmental costs faced by governments, businesses, and wider society.

Such regulations provide clear guidelines for sustainable practice, thus ensuring that businesses are informed of the requirements they must meet to avoid sanctions, what actions they should take to embed sustainable practices, and therefore how businesses can allocate their resources to positively contribute to the overall journey towards decarbonisation.

Accordingly, the continuation of ESG regulation means that businesses must take immediate action to ensure they are accurately monitoring and reporting on their non-financial performance, whilst also taking active steps towards decarbonisation.

Future-proof your business through ensuring alignment with ESG regulations. Book a demo with Plan A today.